How Digital Tools Are Shaping the Future of Home Insurance

Key Takeaways:

- Digital tools are revolutionizing home insurance by enhancing risk assessment, streamlining claims processing, and personalizing policies.

- Technologies like AI, IoT, and blockchain are central to this transformation, offering improved efficiency and customer satisfaction.

- Homeowners are increasingly adopting smart devices, enabling proactive risk management and potentially qualifying for premium discounts.

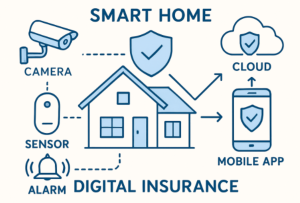

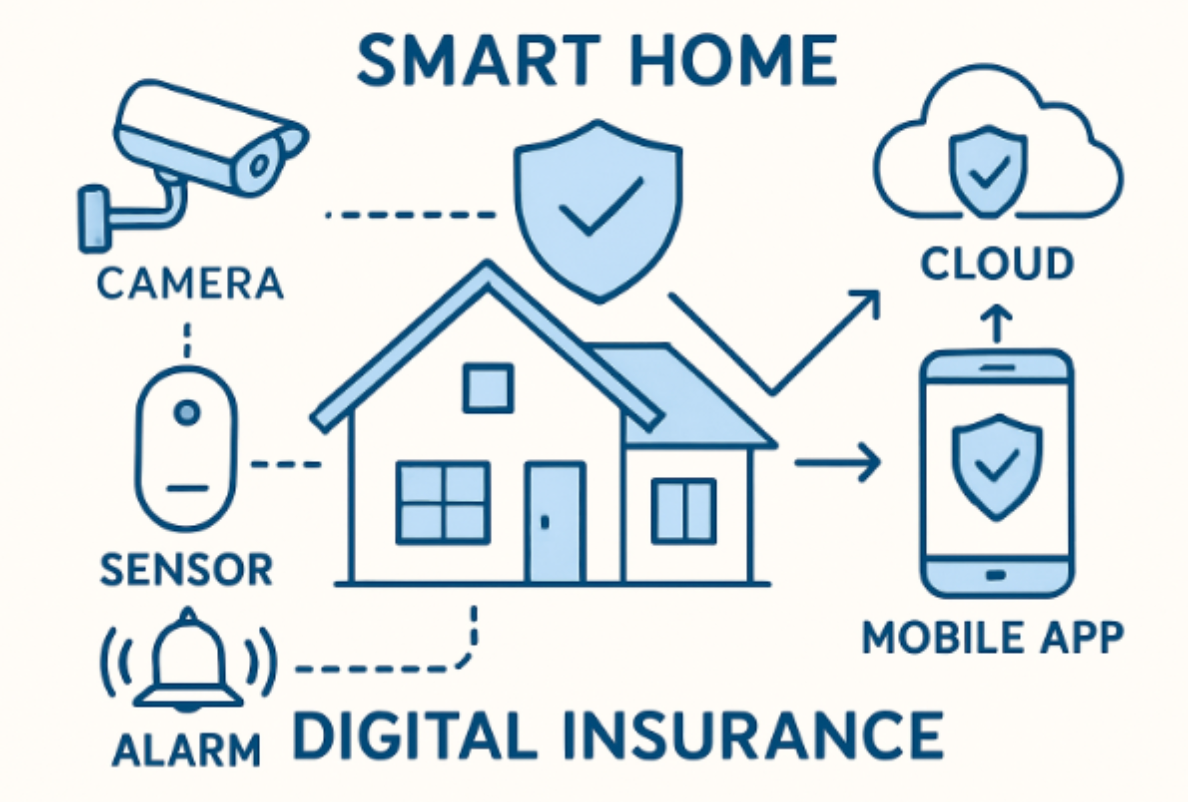

The Rise of Smart Home Technology

The rise of smart home technology has transformed the way people interact with their living spaces. From intelligent thermostats and lighting systems to voice-controlled assistants and connected security devices, these innovations are designed to improve convenience, efficiency, and safety. Smart sensors can detect smoke, water leaks, or unauthorized entry in real time, allowing homeowners to respond quickly and reduce potential damage. As adoption grows, smart homes are increasingly seen not just as a lifestyle upgrade but also as a practical way to manage everyday household risks.

At the same time, the growing popularity of smart home systems has driven a surge in awareness of modern risk-mitigation strategies, with many homeowners turning to insurance brokers in Toronto for guidance on how these advancements can affect their coverage and premiums. Insurers are paying closer attention to how connected devices influence claims and loss prevention, prompting broader conversations about technology, responsibility, and long-term protection. As smart homes become more common, understanding their implications remains an important part of informed homeownership.

Blockchain for Transparency and Security

The insurance industry has historically struggled with complex, paper-intensive processes that are cumbersome, prone to error, and prone to miscommunication. Blockchain technology offers a solution: by storing important transactions and policy details on decentralized, tamper-proof ledgers, all parties can quickly verify the status and legitimacy of a claim or agreement at any given moment.

This transparency fosters greater trust between insurers and customers. Blockchain systems can also reduce administrative costs and errors, making it easier to manage complex claims or multi-party interactions. As the insurance sector evolves, blockchain is positioned to become a foundational tool for creating highly secure, collaborative processes.

Usage-Based Insurance Models

The rise of the Internet of Things (IoT) is leading insurers to experiment with usage-based insurance (UBI) for home coverage. Through real-time data from smart thermostats, water meters, and even occupancy sensors, insurance companies can tailor premiums more accurately to the level of risk associated with each property.

Unlike traditional one-size-fits-all models, UBI rewards homeowners for proactively managing risk, such as by maintaining optimal temperature to avoid pipe bursts or keeping security systems armed. This new approach gives homeowners greater agency and creates a fairer pricing model that reflects actual behavior rather than just demographics or zip codes.

Enhanced Customer Engagement Through Digital Platforms

Digital engagement has transformed how customers interact with their insurers. From user-friendly mobile apps to intuitive online customer portals, homeowners can now obtain quotes, file claims, review policy documents, or update their coverage without visiting an office or waiting on hold. This seamless accessibility empowers homeowners, making it easier than ever to manage their insurance needs.

In addition to simplification, digital touchpoints often offer personalized recommendations, whether it’s advice on reducing risk or suggestions for improving coverage tailored to each customer’s situation. As a result, customer satisfaction and retention are on the rise, as policyholders experience a more transparent and responsive insurance service.

Challenges and Considerations

Despite the benefits, integrating digital tools into home insurance isn’t without its challenges. Data privacy and security are chief among homeowners’ concerns, as smart devices and online platforms collect sensitive data that must be safeguarded against hacking and misuse. Insurers must invest in robust cybersecurity measures and be transparent about data policies so customers feel protected and informed.

Another consideration is equitable access to technology. Not every homeowner has the same resources or comfort level with digital platforms and smart devices, and insurers are tasked with ensuring that new models don’t inadvertently exclude vulnerable populations. Regulatory frameworks are also evolving as technology reshapes industry practices, necessitating continuous adaptation and vigilance from all stakeholders.

The Future Outlook

The future of home insurance is indisputably digital. With advancements in AI, IoT, blockchain, and user-facing platforms, insurers have the tools to craft innovative products that deliver more value, precision, and peace of mind to homeowners. Companies that embrace these changes and foster transparency, security, and accessibility are likely to emerge as industry leaders in the years ahead.

Conclusion

Digital innovation is reshaping home insurance into a more responsive, transparent, and personalized experience for homeowners. As smart technologies and data-driven models continue to evolve, they enable better risk management while strengthening trust between insurers and policyholders. By balancing innovation with privacy, accessibility, and security, the industry is positioned to deliver more resilient and future-ready coverage in an increasingly connected world.